Understanding Finfluencer Impact on Investors¶

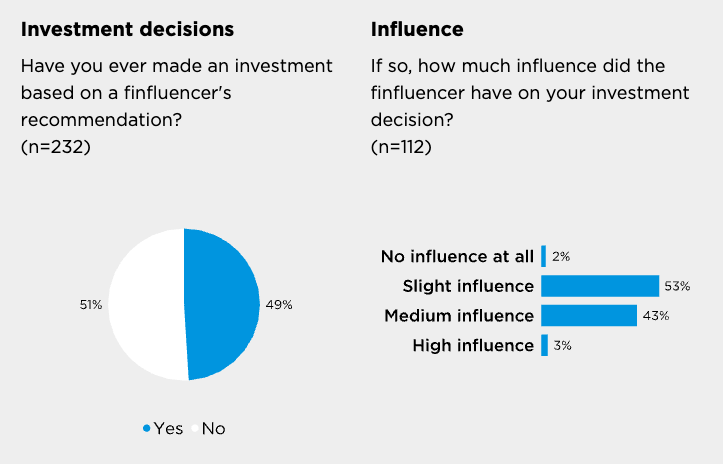

Financial influencers, or 'finfluencers,' wield significant influence, especially among younger investors. But how much do they actually impact investment decisions? This post dives into the key findings of a study by the St. Pölten University of Applied Sciences & Paradots, published in January 2023. Their research surveyed hundreds of young followers of German-speaking finfluencers, offering valuable insights into trust, influence, and the motivations driving engagement in this space.

Key Themes from Research¶

-

Influence & Trust: Studies consistently show finfluencers significantly impact the investment decisions of their followers, particularly younger, less experienced investors ([source needed - add specific study]). Trust is often built through perceived authenticity and relatability rather than proven expertise.

-

Regulatory Scrutiny: Regulators worldwide (SEC, FCA, etc.) are increasingly concerned about misleading advice and undisclosed conflicts of interest. Enforcement actions are rising, highlighting the risks associated with unregulated financial commentary ([source needed - add regulatory report/news]).

-

Performance Measurement Challenges: Academic attempts to measure finfluencer performance face hurdles like inconsistent data, survivorship bias (only successful calls get highlighted), and the difficulty of replicating trading strategies

-

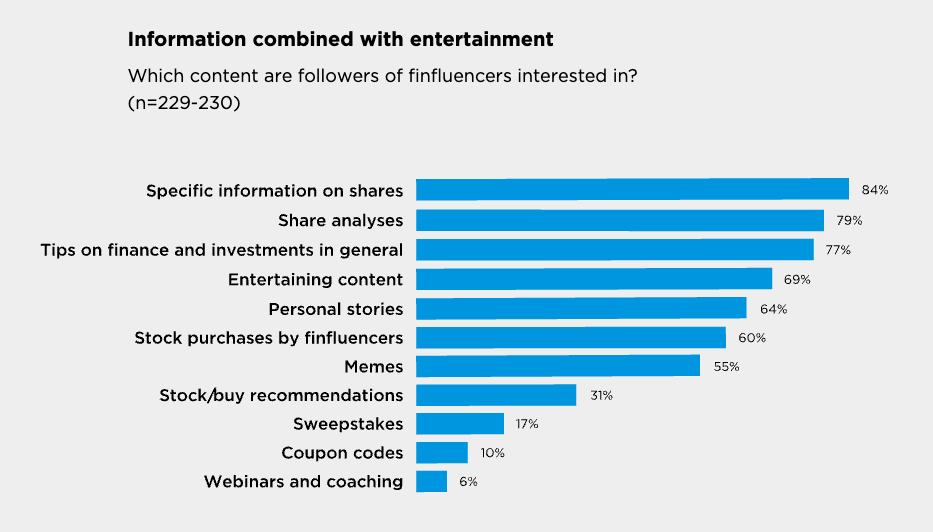

Information vs. Noise: Research suggests that while some finfluencers provide valuable educational content, a significant portion contributes to market noise, potentially leading followers towards herd behavior and speculative bubbles ([source needed - add relevant paper]).

-

Demographics: Finfluencer audiences often skew younger and are more likely to use newer trading platforms. Their appetite for risk can be higher, making them susceptible to hype around specific assets (e.g., meme stocks, crypto).

Gaps & Opportunities¶

While research highlights the influence of finfluencers, there's a clear gap in systematic, objective performance tracking accessible to the public. Most analysis is either academic (and not widely disseminated) or anecdotal.

This is precisely the gap Finfluencers Trade aims to fill. By providing transparent, data-driven analysis of public predictions, the platform can:

- Offer a counterbalance to hype and unsubstantiated claims.

- Help investors evaluate the reliability of different commentators.

- Contribute a unique dataset for further research.

Next Steps¶

The study involved:

- Identifying over 150 German-speaking finfluencers on Instagram.

- Distributing an online survey to 600+ followers via direct messages and story shares.

- Analyzing 300 completed questionnaires from active followers aged 18-34, collected between August and October 2022.

Conclusion¶

Finfluencers are undeniably shaping how a new generation approaches investing. They blend financial education with entertainment, wielding considerable influence over investment decisions. Understanding this dynamic is crucial for investors navigating the modern financial landscape.

Source: St. Pölten University of Applied Sciences & Paradots, Finfluencer Study (January 2023). Retrieved from: https://digital-investor-relations.com/finfluencer.html