The Finfluencer Mirage¶

Navigating the world of online financial advice can feel like searching for a life raft in a stormy sea. Everywhere you turn, "finfluencers" promise quick tips and pathways to prosperity to their vast digital followings. But what if the loudest voices aren't the wisest? What if popularity is a misleading beacon, potentially luring unsuspecting investors towards financial reefs instead of safe harbors?

This isn't just speculation. The promise of accessible guidance from these social media financial gurus often masks a crucial issue: popularity on these platforms doesn't necessarily translate to skill or beneficial advice. A comprehensive study by Kakhbod, Kazempour, Livdan, & Schuerhoff (2023) analyzed millions of tweets and thousands of finfluencers, linking their activity and sentiment with subsequent stock performance. Their work highlights that less skilled finfluencers often attract larger followings. This blog post explores the implications of this finding, particularly how it could lead to an "amplified harm" where lower-quality advice gains disproportionate reach.

To achieve their findings, Kakhbod et al. (2023) undertook an extensive data analysis task. They processed approximately 72 million tweets from nearly 29,000 unique finfluencers. This vast repository of textual data was linked with stock return information and other financial metrics. Their methodology involved sentiment analysis to interpret finfluencer opinions on specific stocks, followed by robust econometric models. These models were crucial in testing the correlation between the expressed sentiment (and other finfluencer characteristics) and the subsequent abnormal stock returns, allowing for the skill-based classification presented.

How Are Finfluencers Distributed by Skill?¶

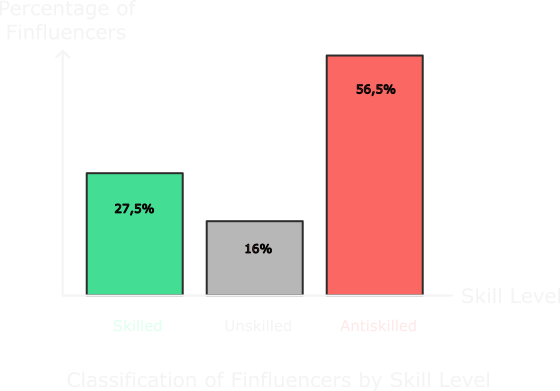

When Kakhbod et al. (2023) peeled back the layers of the finfluencer landscape, they didn't just find a spectrum of talent; they uncovered a startling imbalance. Their research classifies finfluencers into three distinct categories, revealing a distribution that every online investor needs to understand:

| Category | % of Finfluencers | Average Monthly Alpha |

|---|---|---|

| Skilled | 27.5% | +1.86% |

| Unskilled | 16.0% | ~0% |

| Antiskilled | 56.5% | –0.63% |

Pause and let that sink in: more than half of all individuals offering financial guidance online fall into the 'antiskilled' category. This isn't just a matter of neutral advice; it means their recommendations are statistically linked to negative abnormal returns. Meanwhile, the truly skilled—those capable of generating genuine positive alpha—represent just over a quarter of the finfluencer population.

The Finfluencers Majority is Anti-Skilled

Are Skilled Finfluencers Getting Heard?¶

If skilled advice leads to better financial outcomes, one might expect those finfluencers to be the most sought-after. But does the digital megaphone of social media amplify wisdom or just noise? The data on follower counts and activity levels presents a sobering answer.

Prepare for a counterintuitive insight: the path to popularity in the finfluencer world doesn't seem to be paved with skill. In fact, Kakhbod et al. (2023) suggest a potential inverse relationship. For illustrative purposes, imagine a scenario consistent with their findings: if Antiskilled finfluencers, on average, had significantly more followers than Skilled ones, and Unskilled finfluencers fell somewhere in between, the reach of different advice types would be skewed.

For example, if Antiskilled finfluencers were not only the most numerous but also the most popular and active, their constant stream of content could dominate the digital space. This would make it even harder for the less frequent, perhaps more considered, advice from skilled individuals to cut through.

The answer, unfortunately, appears to be no. Skilled finfluencers often do not get the audience their expertise warrants. Their valuable insights can become whispers in a hurricane of content generated by the more numerous and, hypothetically, more popular antiskilled and unskilled cohorts. This isn't just an imbalance; it's a potential fundamental distortion in the marketplace of financial ideas.

Amplified Harm¶

The skewed popularity of less-skilled finfluencers, as suggested by Kakhbod et al. (2023), isn't just an interesting observation; it's the potential engine behind a deeply concerning phenomenon: 'amplified harm.' This is where the sheer volume and reach of poor advice could drown out expertise, creating a distorted information ecosystem for investors.

To illustrate this, let's consider what might happen if, as Kakhbod et al. suggest, Antiskilled and Unskilled finfluencers are both more numerous and individually more popular. The following table presents the finfluencer proportions from Kakhbod et al. (2023) alongside illustrative estimates of mean followers and potential audience reach, derived to explore this "amplified harm" concept:

| Category | % of Finfluencers | Illustrative Mean Followers | Illustrative % of Total Audience Reach |

|---|---|---|---|

| Skilled | 27.5% | ~586 | ~15.5% |

| Unskilled | 16.0% | ~873 | ~13.5% |

| Antiskilled | 56.5% | ~1,303 | ~71.0% |

| Unskilled + Antiskilled | 72.5% | — | ~84.5% |

If these illustrative figures were representative, it would mean that Unskilled and Antiskilled finfluencers combined (72.5% of all finfluencers) could command approximately 84.5% of the total audience reach. This implies that the most harmful advice (from Antiskilled finfluencers) would not only be the most prevalent in terms of raw numbers but also the most widely disseminated. Individuals relying on the most visible online voices would, statistically, be more likely to be exposed to strategies that underperform or lead to losses. The average Antiskilled finfluencer, in this illustrative scenario, has more than twice the followers of the average Skilled finfluencer, and their collective voice could drown out the positive impact of the skilled minority.

Popularity Amplifies Poor Advice

This potential 'amplified harm' effect underscores the critical, urgent need for tools and platforms that can act as a filter, helping investors discern genuine skill from pervasive, potentially harmful noise.

Methodology Note

The Kakhbod et al. (2023) paper classifies finfluencers by skill and provides their proportions but does not offer a breakdown of average follower counts or total audience reach for each skill category. The "Illustrative Mean Followers" and "Illustrative % of Total Audience Reach" figures in the table above are not direct findings from Kakhbod et al. (2023). Instead, they are estimates derived from a modeling exercise performed by Finfluencers.trade, based on the aggregate data and qualitative statements in the Kakhbod et al. paper. These illustrative figures are presented here to help quantify and explain the potential "amplified harm" phenomenon that could arise if finfluencer popularity is indeed inversely related to skill, as suggested by the original research. They demonstrate how a majority of finfluencers (Unskilled and Antiskilled) could command a disproportionately large share of the audience.

Why Contrarian Strategies Might Work¶

Given that the loudest voices in the finfluencer sphere often belong to the least skilled, it logically follows that 'herding'—simply following the most popular trends—can be a shortcut to disappointing results. This is where contrarian strategies gain their power. By definition, going against the crowd in such a distorted market means you're more likely to sidestep the amplified chorus of poor advice and potentially uncover value that the majority overlooks.

However, a word of caution is warranted. Blindly following any self-proclaimed contrarian isn't a foolproof strategy either. True contrarian success hinges on the contrarian also possessing genuine skill. There's a distinct difference between a skilled investor who thoughtfully goes against prevailing sentiment and a finfluencer who is 'constantly contrarian' merely for the sake of being different, potentially missing out on major market movements or offering poorly-timed advice. Discerning a skilled contrarian from a perma-bear or a market misreader requires the same level of diligence as assessing any other finfluencer.

Identifying Skill and Avoiding Pitfalls¶

The data paints a clear, if unsettling, picture: a finfluencer's popularity is an unreliable—and often inverse—indicator of their skill. So, how does an investor navigate this treacherous landscape without getting led astray?

While a deep dive into individual due diligence is always wise, the sheer volume of voices makes this challenging. Key indicators from the research suggest: * Red Flags: Be cautious of those with extremely high engagement metrics but little substantive, verifiable analysis, or those who consistently promote high-risk ventures without acknowledging downsides. These traits often correlate with the "antiskilled" majority. * Green Shoots: Look for finfluencers who demonstrate a track record of reasoned analysis (even if less "viral"), transparency about their methods, and a focus on education over hype. These are more likely to be among the "skilled" minority.

But let's be realistic: manually sifting through the digital deluge, cross-referencing every claim, and psychoanalyzing every guru is a full-time job. This is precisely the challenge finfluencers.trade is built to address. I'm developing the tools to do the heavy lifting, cutting through the noise with data-driven insights. My goal is to make it simpler for you to identify potentially harmful accounts and, more importantly, to discover those genuinely skilled individuals whose wisdom might currently be drowned out.

In a world where harmful financial advice is amplified by popularity, passive consumption is a risk. It's no longer enough to simply follow; you need to discern. finfluencers.trade is committed to arming you with the tools for that discernment. I'm building a platform to help you track performance, analyze sentiment, and spot red flags—not just to avoid the pitfalls, but to confidently identify and learn from the credible voices in the crowd.

Key Takeaways¶

- The majority of finfluencers (over 70%) are classified as unskilled or antiskilled, meaning their advice often leads to neutral or negative investment returns.

- Counterintuitively, less skilled finfluencers often command larger audiences, creating an "amplified harm" effect where suboptimal advice has the widest reach.

- Relying on popularity is risky; finfluencers.trade aims to equip you with data to both avoid harmful advice and identify skilled finfluencers offering credible guidance.

Sources¶

- Kakhbod, A., Kazempour, S. M., Livdan, D., & Schuerhoff, N. (2023). Finfluencers. Swiss Finance Institute Research Paper No. 23-30. Available at SSRN: https://ssrn.com/abstract=4428232